If you manage beverage operations, you’re likely facing increasing pressure to improve sustainability efforts.

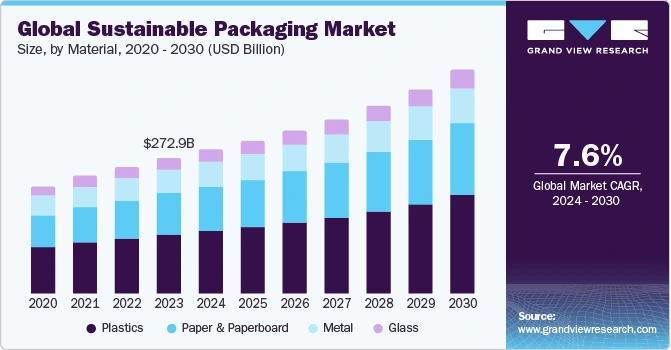

With the global sustainable packaging market projected to reach USD 448.53 billion by 2030, now is the time to embrace eco-friendly packaging solutions that align with industry trends.

However, adopting sustainable beverage packaging comes with complications. Not only should you update the packaging itself, but you should also know how to dispose of it in an environmentally friendly way.

With limited recycling infrastructure, high costs, and a general lack of industry knowledge, many companies struggle to determine how to approach sustainable beverage packaging.

This detailed guide helps operations managers, sustainability officers, and business owners address these challenges by exploring different types of beverage packaging, disposal requirements, and emerging revenue opportunities.

Key Takeaways

- Traditional waste management systems weren’t designed to handle recyclable or compostable materials like bio-resins, polymers, and multi-layer composites, creating a disconnect that is reshaping the economics and logistics of beverage product destruction.

- Regulatory compliance is essential for companies handling recyclable food packaging, requiring certification, documentation, and audits to avoid costly penalties and protect brand reputation.

- Aluminum and glass remain leading sustainable beverage packaging materials, offering full recyclability, reduced emissions, and efficient resource use.

- Extended Producer Responsibility (EPR) programs shift the cost and responsibility of managing end-of-life products from taxpayers to producers, ensuring more sustainable packaging and waste management practices.

Why Sustainable Beverage Packaging Requires New Destruction Approaches

Market growth in sustainable packaging is expected to be driven by bans on single-use plastics, extended producer responsibility (EPR) laws, and incentives for using environmentally friendly packaging materials.

However, sustainable packaging is only as effective as its end-of-life pathway in real-world conditions. The issue?

Traditional waste management systems weren’t designed to handle recyclable or compostable materials such as bio-resins, polymers, and multi-layer composites. This disconnect is reshaping the economics and logistics of product destruction across the beverage industry.

Across Shapiro’s 200+ facility network, which has processed over one billion containers, we’ve documented these cost shifts firsthand. Differences in traditional and sustainable packaging materials reflect the added sorting, segregation, and processing steps required as the industry transitions away from petroleum-based packaging.

These insights highlight the urgent need for modernization in destruction and recycling infrastructure to keep pace with the rapid growth of sustainable materials.

While our extensive experience managing sustainable beverage packaging enables us to identify cost-effective destruction solutions, broader infrastructure and innovation are still needed to keep pace with the rapidly evolving market.

For Operations Managers: Sustainable materials can introduce longer processing times and added steps compared to traditional packaging, requiring updated workflows and training.

Five Types of Beverage Packaging Creating New Destruction Challenges

While sustainable beverage packaging has an array of benefits, it also introduces more complex processing and destruction requirements.

Let’s take a look at key types of beverage packaging that should be on your radar:

1. Biodegradable and Compostable Materials (PLA, PHA, Cellulose)

While compostable and biodegradable containers for liquids help reduce landfill dependency, they must be kept separate from conventional plastic to prevent recycling challenges.

As stated by the EPA: “Compostable plastics are not intended for recycling and can contaminate and disrupt the recycling stream if intermixed with petroleum-based plastics that are non-compostable.”

2. Multi-Layer Composite Packaging

Multi-layer packaging is difficult to recycle, as the different layers of materials make it hard to separate. Take Tetra Pak, for instance—its combination of paperboard, polymers, and aluminum ensures product protection but complicates recycling due to the need for distinct processing methods.

To successfully recycle the different materials of multi-layer products, specialized facilities are required to separate and process each component individually.

3. Lightweight Plastic Innovations

Without fundamental redesign and innovation, about 30% of plastic packaging will never be reused or recycled. To address this issue, lightweight plastic—or low-density plastic—has emerged. The challenge?

Lightweight plastics present processing challenges, including shredding equipment incompatibility and a higher risk of contamination due to their thin, flexible walls.

4. Plant-Based Bottles and Containers

Plant-based bottles, such as PLA bottles and algae-based containers, closely resemble PET materials in appearance but differ in processing requirements. As a result, they demand clear identification and sorting instructions, since limited infrastructure, food residue contamination, and consumer confusion often lead to improper recycling.

5. Smart Packaging with Electronic Components

Smart packaging is used to extend shelf life, monitor freshness, display information on quality, and improve product and customer safety. However, electronic components such as QR codes, RFID tags, and freshness sensors must be recycled carefully to avoid mixing electronics with conventional packaging waste.

To ensure proper handling, smart packaging should be paired with clear separation protocols that distinguish electronic elements from recyclable materials before processing.

Destruction Requirements by Packaging Type

| Material | Separation Required | Temperature Requirements | Processing Time | Cost |

|---|---|---|---|---|

| Biodegradable/Compostable | Must be kept separate from petroleum-based plastics to avoid contamination | Industrial composting conditions (e.g., ~ 131-160 °F) | Longer than conventional plastics | Significantly higher than standard |

| Multi-Layer Composite Packaging | Each layer must be separated | Varies by component | Considerably longer due to complexity | Higher due to specialized processing |

| Lightweight Plastic Innovations | Requires proper sorting; thin-walled plastics need special handling | Generally similar to standard plastics, but may require lower or controlled heating | Processing slower due to equipment compatibility issues | Potentially higher than standard plastics due to increased contamination risk |

| Plant-Based Bottles & Containers | Must be clearly identified and sorted separately from PET streams | Processing may require specialized conditions | Longer if infrastructure not fully adapted | Higher because of niche infrastructure and sorting needs |

| Smart Packaging with Electronic Components | Electronics must be removed / separated before recycling | Varies (may involve e-waste protocols rather than standard thermal) | Longer due to disassembly and separation steps | Much higher due to dual waste stream (packaging + electronics) |

At Shapiro, our systems handle all five material categories, with specialized equipment to ensure processes are efficient and sustainable.

For Sustainability Officers: Some material types require dedicated Scope 3 emissions documentation; work with the best beverage destruction companies can help you provides category-specific certificates to support compliance.

Compostable Food & Beverage Packaging: Destruction Requirements and Certification

What destruction requirements should you know about?

Here’s a quick overview:

Industrial Composting Requirements for Beverage Containers

Commercial composting, a large-scale process that supports environmental sustainability, handles everything from liquid extraction and contamination screening to temperature-controlled composting.

To promote rapid decomposition of compostable food packaging, the temperature range of the compost pile should be between 131 and 160 degrees Fahrenheit.

Since this process requires precise temperature control and careful management, beverage destruction can be challenging for home composters, making industrial composting solutions a more reliable choice for handling large volumes of waste.

Certification Verification and Compliance Documentation

Food and beverage regulatory compliance is a key consideration for companies handling compostable food packaging.

For instance, the BPI Certification program is a third-party verification of ASTM standards for compostable products in North America. Specifically, ASTM D6400 establishes standards for identifying products and materials that will compost satisfactorily in commercial and municipal composting facilities.

In addition to national standards, there are numerous state-specific regulations that companies must follow—often involving extensive documentation such as chain-of-custody tracking and annual compliance audits.

Organizations must not only comply with these laws but also maintain detailed records to demonstrate adherence during reviews. Failing to do so can result in costly penalties and reputational damage.

At Shapiro, we’ve maintained zero regulatory citations across more than one billion containers destroyed, so you can focus on your business knowing compliance is covered.

Recyclable Materials: The Revenue Opportunity in Packaging Destruction

Waste management in the beverage industry is complex, but that doesn’t mean there isn’t significant opportunity to enhance sustainability.

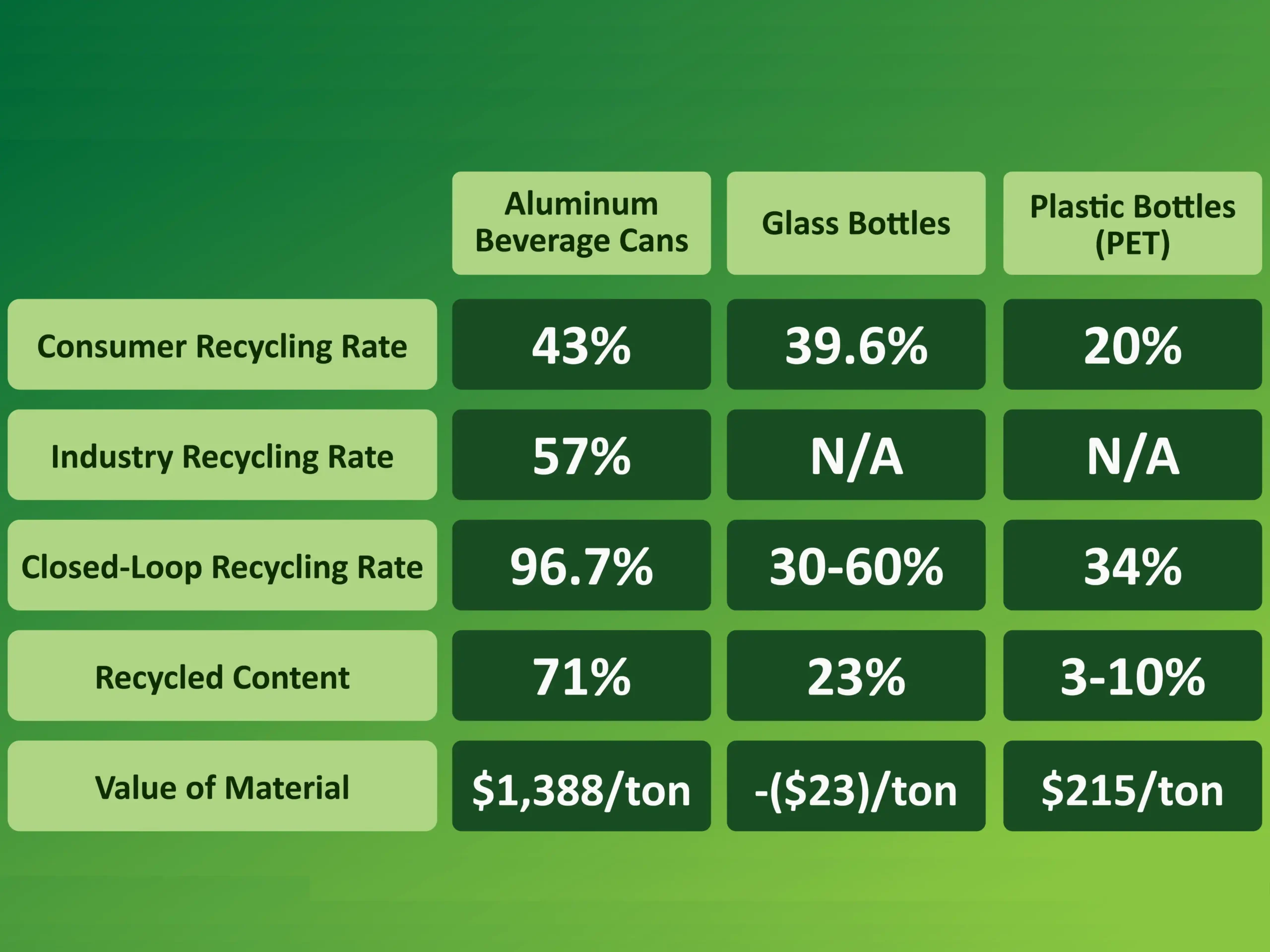

Two key materials for recyclable food packaging are aluminum and glass.

Aluminum and Glass: Destruction That Generates Value

Aluminum makes beverage cans lighter, easier to ship, and infinitely recyclable.

In 2018, the total recycling rate of aluminum containers and packaging was 34.9%, of which the most recycled category of aluminum was beer and soft drink cans.

In fact, aluminum cans are the most recycled beverage container, with billions of used cans recycled by the U.S. aluminum industry each year, making them a leading solution for sustainable beverage packaging.

Glass is another 100% recyclable and reusable material, thereby saving resources and energy. In addition, product innovations that reduce the thickness and weight of glass packaging can lower CO₂ emissions by around 4%–5%.

The image below compares the recycling rate of aluminum, glass, and plastic (PET).

The Challenge: Lightweighting and Material Recovery

The push for lighter, more sustainable packaging has created a growing tension between innovation and infrastructure. While advancements in aluminum and plastic design have made containers thinner and more resource-efficient, these innovations also pose challenges for recycling systems.

Lighter materials can be more difficult to sort and process, often reducing their recovery value. Many facilities require costly equipment upgrades and sufficient processing volumes to make recovery economically viable. In addition, transportation logistics, storage needs, and handling requirements add further complexity.

Balancing material innovation with the infrastructure needed to recycle it effectively remains a key challenge in advancing circular packaging solutions.

Regulatory Evolution: New Compliance Requirements for Beverage Destruction

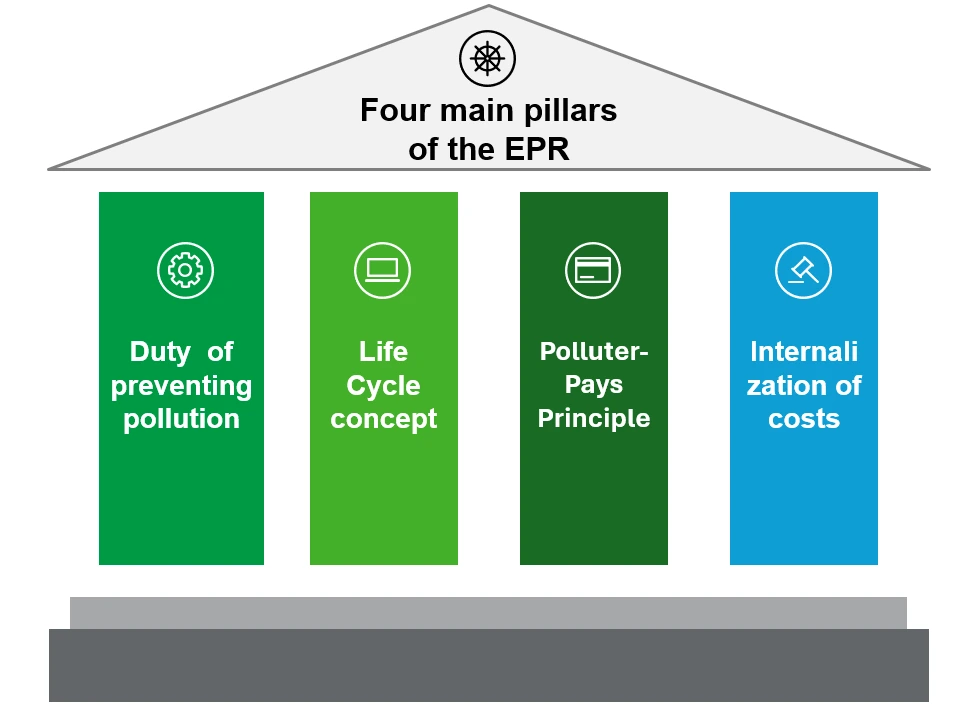

EPR Programs

Extended Producer Responsibility (EPR) programs are now active in seven states, including California, Colorado, Oregon, and Maine. The goal of EPR is to hold producers accountable for the end-of-life management of their products, making businesses responsible for paying the costs associated with that process.

This program is a specially designed environmental policy approach that shifts the burden of managing certain end-of-life products from municipalities and taxpayers to the producers who place those products on the market.

FDA and TTB Requirements for Sustainable Materials

Food contact regulations ensure that packaging materials used in food and beverage products meet strict safety and compliance standards. New materials must undergo FDA Food Contact Substance (FCS) notifications and migration testing—especially for bioplastics—to confirm they don’t transfer harmful substances.

Alcohol producers face additional requirements, including TTB labeling approvals and proper destruction documentation for tax credit recovery.

For global brands, compliance extends beyond U.S. borders, with EU standards like REACH and PPWR influencing domestic practices and shaping how companies manage destruction, labeling, and material traceability worldwide.

How Modern Destruction Partners Address Sustainable Beverage Packaging Complexity

As sustainability goals evolve, modern destruction partners play a critical role in helping brands manage the growing complexity of sustainable beverage packaging.

Essential Capabilities for Processing Modern Beverage Packaging

When evaluating partners for processing compostable packaging for liquids, it’s important to assess a full range of operational and compliance capabilities:

- Multi-material processing infrastructure: Your partner should be equipped to handle five or more material types, operate efficient liquid separation systems, and use precise material identification technology.

- Facility network and capacity: They should have nationwide coverage with at least 200 facilities, along with specialized equipment to ensure consistent performance and business continuity.

- Compliance and documentation systems: They should offer real-time tracking, material-specific Certificates of Destruction, seamless integration with EPR systems, and maintain a spotless regulatory compliance record.

- Material recovery pathways: Experienced waste management companies support beneficial reuse programs, partner with renewable energy initiatives, and provide flexible capacity for seasonal fluctuations or emergency responses.

- Volume considerations: They should specify minimum and maximum throughput by material type, provide seasonal flexibility, and maintain rapid emergency/recall response capabilities.

Shapiro stands out for our commitment to sustainability and operational excellence, highlighted by our renewable energy initiatives at the Linden renewable energy facility. This site integrates energy-efficient systems and renewable power sources, minimizing environmental impact and ensuring consistent, compliant performance.

Total Cost of Ownership: Beyond Per-Container Pricing

When evaluating providers for processing biodegradable packaging for food and other materials, it’s important to look beyond per-container rates and consider the true total cost of ownership.

- Direct destruction costs: Consider base processing fees, material-specific premiums, and transportation logistics that can significantly affect total expenses.

- Compliance costs: Factor in documentation, certification verification, audit support, and penalty avoidance—areas where partners with proven compliance systems can help minimize risk.

- Opportunity costs/benefits: Advanced recovery programs and renewable energy initiatives can generate material recovery revenue and renewable energy credits.

- Risk mitigation value: Nationwide facility networks provide redundancy, liability protection, and brand safety through certified disposal. Shapiro’s locations exemplify how strategic coverage supports business continuity.

For business owners: Many clients see significant long-term cost savings through improved material recovery, renewable energy integration, and stronger compliance practices.

Future-Proofing Your Beverage Destruction Strategy

You shouldn’t just stay aware of current trends—you also need to plan for what’s ahead. Here’s what you need to know:

Emerging Technologies and Infrastructure Needs

Emerging technologies are redefining how companies manage material destruction, sustainability, and compliance. Key developments include:

- Smart packaging: QR codes, RFID tags, and freshness indicators are improving traceability and transparency while introducing new e-waste disposal protocols and data privacy considerations during destruction.

- Advanced bioplastics: Innovations like PHA and algae-based materials require updated processing methods, specialized handling, and equipment modifications to ensure compliant and efficient destruction.

- Edible packaging: Edible packaging, such as films and coatings designed for consumption, reduces the need for extensive destruction infrastructure but still requires strict FDA compliance oversight.

- Infrastructure investment priorities: Businesses are prioritizing automated sorting and identification systems, modular processing equipment, digital tracking integration, and expansion of geographically diverse facilities to enhance sustainability and operational efficiency.

- Plan for 2026–2030: Expect major regulatory shifts, including the expansion of state EPR programs to 15+ states, the introduction of federal packaging standards, and accelerated international harmonization aligning U.S. policies with global sustainability frameworks.

Your 90-Day Action Plan

Interested in getting started?

Here’s a 90-day implementation plan:

- Phase 1: Audit (Days 1–30): Assess your current packaging mix and volumes, evaluate existing destruction partner capabilities, identify compliance and documentation gaps, and determine the true total cost of ownership.

- Phase 2: Evaluate (Days 31–60): Develop Request for Proposal (RFP) criteria for sustainable packaging destruction, assess partner capabilities, perform cost-benefit analyses by material type, and evaluate long-term scalability.

- Phase 3: Implement (Days 61–90): Finalize partner selection or renegotiation, integrate documentation systems, train staff on new requirements, and establish an ongoing monitoring framework to ensure compliance and operational efficiency.

Conclusion

As expectations and legal requirements for sustainable beverage packaging continue to grow, companies must stay proactive in updating their packaging and destruction practices.

As discussed throughout this article, different types of beverage packaging require specialized destruction processes. Factors such as infrastructure limitations, contamination risks, and lack of proper handling knowledge can all impact the success of these efforts.

At Shapiro, we bring extensive experience in beverage destruction—safely recycling and disposing of everything from soft drinks and wine to fruit juice and other liquid products each year.

From collection and recycling to issuing Certificates of Destruction, our team ensures every step is compliant, efficient, and environmentally responsible.

Contact us today to learn more about our beverage destruction services.

FAQs about Sustainable Beverage Packaging

You can verify your destruction partner’s ability to handle new packaging materials by requesting documented processing capabilities, recent compliance records, and examples of successful destruction or recycling of similar materials.

If sustainable beverage packaging is destroyed incorrectly, it can lead to regulatory non-compliance, environmental contamination, loss of recoverable materials, and potential brand or financial penalties.

Multi-layer beverage containers are separated during destruction through specialized depackaging and hydropulping systems that use water and mechanical agitation to break down the layers, allowing fibers, plastics, and aluminum to be isolated and processed through their respective recycling or recovery streams.

In many cases, yes—aluminum beverage cans often generate enough recycling revenue to partially or fully offset destruction costs, thanks to their high market value, strong demand in secondary markets, and the material’s ability to be endlessly recycled without quality loss.

Baily Ramsey, an accomplished marketing specialist, brings a unique blend of anthropological insight and marketing finesse to the digital landscape. Specializing in educational content creation, she creates content for various industries, with a particular interest in environmental initiatives.